Brexit and auto-enrolment pensions are joint-leading business concerns – R3

10 May 2016

The possibility of the UK leaving the EU and the challenges of introducing auto-enrolment pensions were the joint-leading financial concerns for UK businesses, according to research by insolvency trade body R3.

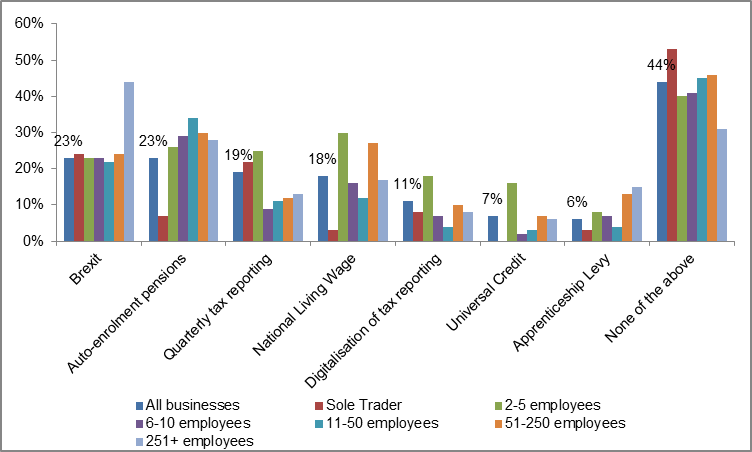

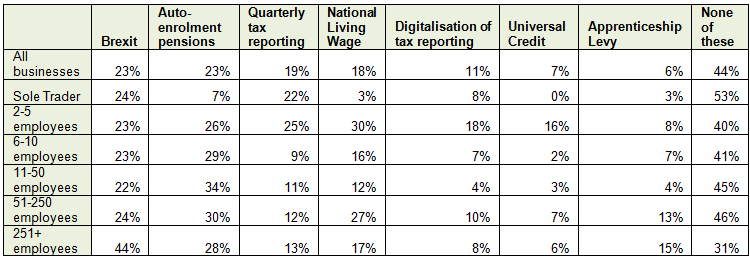

When prompted with a number of possible business concerns, 23% of UK businesses said they were concerned that ‘Brexit' would have a significant financial impact on them, and another 23% said they were concerned about the impact of auto-enrolment pensions.

Other business worries recorded by R3 include: the introduction of quarterly tax reporting (19% of businesses are concerned); the introduction of the National Living Wage (18%); the digitalisation of tax reporting (11%); the introduction of Universal Credit (7%); and the introduction of an Apprenticeship Levy (6%).

Andrew Tate, R3 president, says: "Although the Brexit debate is grabbing the headlines, it's important to remember that businesses face a plethora of other incoming regulatory and compliance challenges. Just as many businesses - especially smaller ones - are worried about auto-enrolment pensions as are worried about Brexit."

"And while Brexit might not come to pass, auto-enrolment pensions and the National Living Wage will definitely have to be dealt with by businesses."

"That said, as you would expect, the possibility of leaving the EU is playing on the minds of a significant number of business decision-makers. Uncertainty over such an important issue could well affect investment and planning decisions over the next few months. Generally, levels of business confidence and economic optimism are holding up though."

50% of businesses expect their activity to increase in the next 12 months compared to the past year (5% expect a decrease), while 50% of businesses are more optimistic about the economy now than they were three months ago (16% are more pessimistic).

The research is from R3's Business Distress Index, a long-running survey of 500 UK businesses.

The research also found that a business' main financial concerns changed significantly depending on the business' size.

The most common concern for large firms (employing 251+ people) is the UK leaving the EU (44% worried about the financial impact), while the biggest concern for businesses employing 2-5 people is the financial impact of the introduction of the National Living Wage (30%).

Andrew Tate says: "Although, overall, the vast majority of businesses do not have any Brexit concerns, almost half of the largest employers are worried about the prospect of leaving the EU. Similarly, the worries about the National Living Wage are far more acute for the smallest employers than they are for the wider business community."

56% of businesses expressed concern about at least one development listed by R3.

Andrew Tate adds: "UK businesses have enjoyed a period of widespread, rapid growth, boosted over the last year by low inflation and low fuel costs. However, as well as slowing economic growth, businesses will have to contend with a range of new compliance and reporting burdens in the next few years. This could put some businesses' finances under significant pressure."

69% of businesses employing over 251 people had at least one concern (compared to 47% of sole traders), while businesses employing 2-5 people were the most likely to have three or more concerns (18%).

Issues UK businesses think will have a significant financial impact, by business size

Notes

Research undertaken by BDRC Continental, an award-winning insight agency. Questions were put to 500 UK businesses via BDRC Continental's monthly Business Opinion Omnibus. Telephone-based interviews with a nationally representative sample of senior financial decision makers across the UK, weighted by size, region and sector. Fieldwork dates 7th - 17th March 2016.

- R3 Blog Member news, commentary and analysis from R3

- Policy & Research Insights into the economy and the insolvency and restructuring, and recommendations for reform

- Consultation Responses Our responses to Government consultations on insolvency and restructuring issues

R3 members can provide advice on a range of business and personal finance issues. To find an R3 member who can help you, click below.

Stuart McBride

Stuart McBride Amelia Franklin

Amelia Franklin Lyle Horne

Lyle Horne